Home » Project Overview » Haib Copper

The Haib deposit has a distinct surface expression with abundant copper staining on fractures and joint planes, particularly in and around the dry river bed of the Volstruis River. This led to German prospectors identifying the deposit around the late 1800s or early 1900s. Small tonnages of high grade copper carbonate ore were mined at this time.

After World War II, the prospect was pegged as claims by prospector Mr. George Swanson who carried out small scale mining and tank leaching operations. Over 6,000 tons of hand sorted high-grade copper ore were sold to the O’okiep Copper Mines, across the border at Nababeep in South Africa, reportedly at grades of up to 18% Copper.

In 1963 – 1964 Falconbridge completed a moredetailed exploration programme looking at the higher grade zones within the Haibdeposit. They drilled some eleven diamond drillholes totalling 1,012 metres of drilling. The average grade of the drillhole intersections was given as 0.33% Cu.

During 1968 – 1969 King Resources of South Africa Pty Ltd conducted a diamond drilling programme of 21 holes totalling 3,485 metres. They examined both lower and higher grade sulphide zones, as well as the higher gradeoxide shear zones.

During 1972 – 1975 Rio Tinto Zinc (“RTZ”) conducted the first extensive and systematic investigation of the Haib deposit. Geochemical and chip sampling surveys were conducted along with IP and Resistivity surveys. They drilled one 120 diamond drillholes totalling 45,903 metres. The cores from this programme are still intact and stored in a core shed on site. RTZ sampled by compositing half cores over 2 metre intervals and submitted these for determination of total copper and where appropriate, oxide copper (acid soluble copper). Composite samples from each drillhole were also tested metallurgically to determine recoverable copper and were assayed for molybdenum, silver and gold indicating average contents of 25 g/t Mo, 0.01 g/t Au, and 0.9 g/t Ag. Tonnage and grade estimates at various cut-offs were made and a conceptual pit design was proposed.

In November, 1993 Rand Merchant Bank Ltd of South Africa acquired an option over the Haib property. Venmyn Rand Pty Ltd., produced a study of the project including compilation ofall the available drillhole and assay records from previous investigations and set up a computerised drillhole database. It was concluded that the increase in the copper price since the 1970’s, development of low cost / high tonnage mining systems and new and refined technologies such as bacterial leaching, solvent extraction and electro-winning combined to create a situation where development of the Haib deposit could represent an economic project; however, no further exploration work was done and work terminated in 1995.

In March 1995, Great Fitzroy Mines NL (“GFM”) and RMB Mr. George Swanson signed a joint venture called Namibian Copper Joint Venture (“NCJV”). From 1995 to 1999, NCJV drilled a 12 infill holes, drilled 5 geotechnical investigation holes, completed 126 metres of excavation in an adit and two crosscuts for bulk sampling and metallurgical testing and carried out various test works including mining cost audits, bio-leaching studies, and milling and grinding studies. NCJV ran into financial difficulties and work was stopped at the Haib deposit in early 1999.

In 2004, Koryx Copper(Pty) Ltd (Koryx Copper) was granted the Exclusive Prospecting licence 3140 (EPL) was granted over an area of 74,563.0 ha covering the deposit and a very large surrounding area. This was subsequently renewed in April 2007, 2009, 2011, 2013 and 2015 with the area reduced to 37,000ha after the 2007 renewal.

From 2008, Teck under the option Agreement with DSM has completed a comprehensive exploration programme at the Haib and immediate surroundings. (results discussed in the other sections below).

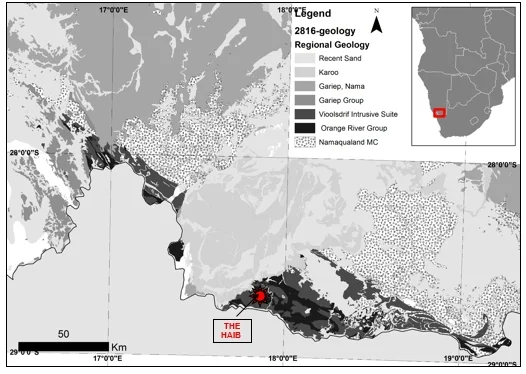

The Haib copper deposit is in the extreme south of Namibia close to the border with South Africa, which is defined by the course of the Orange River. The deposit lies some 12 – 15 kilometres east of the main tarred interstate highway connecting South Africa and Namibia and the nearest railway station is at Grunau, some 120km north on the main highway. This rail connection could provide access to either the port of Luderitz or to Walvis Bay via Windhoek or to South African ports or facilities via Upington.

The Haib deposit is located within part of the Namaqua-Natal Province called the Richtersveld geological sub-province which is further subdivided into a volcanosedimentary sequence (locally, the Haib Subgroup), the Orange River Group and the intrusive Vioolsdrift suite which are closely related in space and time. The Orange River Group is composed of sub-aerial volcanic rocks and reworked volcaniclastic sediments; deformation caused displacements along stratigraphic contacts before intrusion of the Vioolsdrift suite. The predominance of andesitic and calc-alkaline magmatic rocks with tectonic compression prevailing throughout the magmatic episode has led to an interpretation of an island-arc model for the region. Recent mass spectrography indicated an age of 1,880 Ma for the volcanics.

The principal mineralised hosts at the Haib are a Quartz Feldspar Porphyry (QFP) and a Feldspar Porphyry (FP) – see Figures 4 and 5 below. The QFP is interpreted as a quartz diorite body which intruded the feldspar porphyry some 1,868 ± 7Ma . The FP is generally interpreted as being part of the suite of andesitic rocks although some workers have suggested that it too, may be partially of intrusive origin. The QFP is elongated along the orientation of the Volstruis Valley, largely coincident with the location and orientation of many of the higher grade intersections within the deposit. The sequence has undergone low grade regional metamorphism to greenschist facies which event has been dated at 1,100Ma. Most of the rock exhibits typical porphyry copper type alteration zones associated with mineralisation. A potassic hydrothermal alteration zone coincides with the main mineralised area surrounded by phyllic and propylitic alteration haloes. Propylitic and sericitic alteration appears to overprint the earlier potassic zones. Silicification, sericitisation, chloritisation and epidotisation are widespread.

A 43-101 Mineral Resource estimate, has been prepared for Koryx Copper by P & E Walker Consultancy and Obsidian Consulting Services, both of South Africa, in accordance with the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. The report is dated January 15, 2018.

Table-1: Classified mineral resources of the Haib Project at a 0.25% Cu cut-off grade:

| Resource Class | xMillion Tonnes | Cu(%) | Contained Cu x billion lbs |

|---|---|---|---|

| Indicated | 456.9 | 0.31 | 3.12 |

| Inferred | 342.4 | 0.29 | 2.19 |

Notes:

Table 2. Haib Copper Indicated Mineral Resources, Sensitivity Cases.

| %Cu Cut-off | xMillion Tonnes | Cu(%) | Contained Cu x billion lbs |

|---|---|---|---|

| 0.20% | 904.8 | 0.27 | 5.39 |

| 0.25% | 456.9 | 0.31 | 3.12 |

| 0.30% | 219.8 | 0.36 | 1.74 |

Table 3. Haib Copper Inferred Mineral Resources, Sensitivity Cases.

| %Cu Cut-off | xMillion Tonnes | Cu(%) | Contained Cu x billion lbs |

|---|---|---|---|

| 0.20% | 686.2 | 0.26 | 3.93 |

| 0.25% | 342.4 | 0.29 | 2.19 |

| 0.30% | 109.8 | 0.34 | 0.82 |

This Haib Copper Mineral Resource has been defined by diamond core drilling covering a total surface area of some 2.6 square kilometres. The mineral resource classification is closely related to data proximity. Topographic elevations within the mineral resource area vary from 320m to 640m above mean sea level and average 480m above mean sea level. Indicated resources are constrained between the variable topographic surface and a horizontal level which is 75m above mean sea level and within which the majority of the drill and assay data are constrained. Inferred resources are laterally constrained by the last line of drill holes and extend vertically from the horizontal surfaces defined by the +75m and -350m above mean sea level ( a block of 425m thickness) within which there is a lesser data set derived from drilling.

Mineral Resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates ar based on Indicated Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. However, there is no certainty that these indicated mineral resources will be converted to measured categories through further drilling, or into mineral reserves, once economic considerations are applied. There is no certainty that the preliminary economic assessment will be realized.

Mineralization is open near surface and at depth to at least 800 metres deep. The Mineral Resource estimate is based on the results from approximately 66,500 metres of drilling in 196 holes. The most recent drilling data comes from Teck Resources drilling programs totalling 14,500 metres (2010 & 2014) and from re-assaying a part of the 164 historical drill cores which are well preserved on site. Indicated Resources are defined by a drill grid of 150 metres by 150 metres, while Inferred Resources are defined by a drill grid of 300 metres by 150 metres.

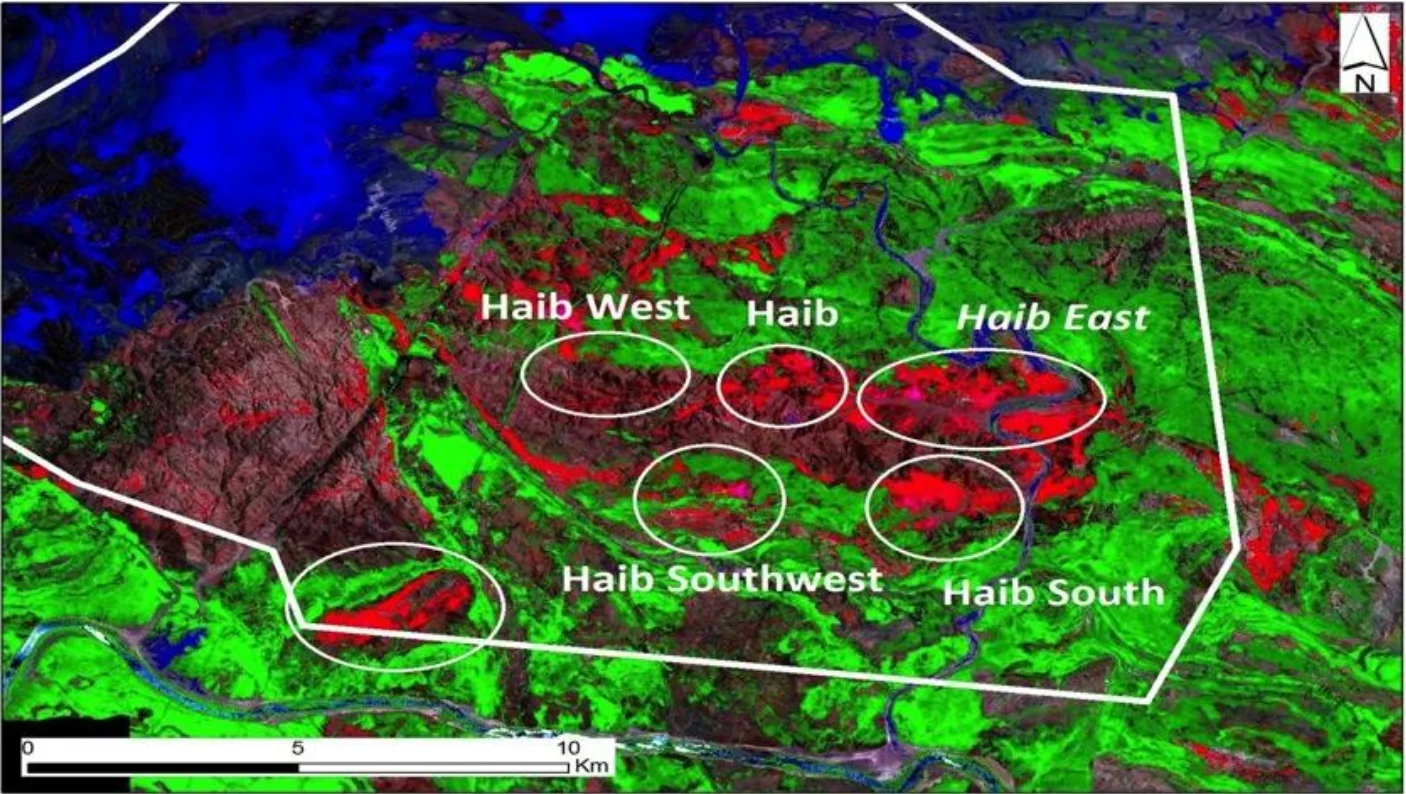

The Haib Copper exploration licence provides significant potential for resource expansion, since there is known, but poorly drilled and assayed, mineralisation beyond the drill grid boundaries and below the main mineralised body (which covers some 2 square kilometres of surface area), where a few drillholes from 75m above mean sea level to -350m above mean sea level (i.e. a thickness of 425m) have shown that mineralisation is present. The deepest drillhole did not pass out of mineralised material. In addition (see map below), there are 5 satellite mineralised target areas surrounding the main Haib porphyry body which still require further evaluation.

Map 1 – The location of the Haib porphyry deposit and satellite targets within the exclusive prospecting licence area.

Qualified Persons

Peter Walker B.Sc. (Hons.) MBA Pr.Sci.Nat. of P & E Walker Consultancy is the main author of the 43-101 resource estimation report and is responsible for the technical part of this press release, and is the designated Qualified Person under the terms of National Instrument 43-101.

Mr. Dean Richards Pr.Sci.Nat. , MGSSA – BSc. (Hons.) Geology, of Obsidian Consulting Services is the contributing author of the 43-101 resource estimation report and is a Qualified Person under the Terms of the National Instrument 43-101.

A Preliminary Economic Assessment (“PEA”) has recently been completed by Mineral Engineering and Technical Services of Australia (“METS”) on the Haib Copper project in Namibia.

Highlights of PEA

The recent leaching test-work was carried out by Mintek of South Africa. Mintek is a world leader in Bio-leaching technologies.

Amenability test work confirmed copper recoveries of up to 95% in bacterially assisted heap leaching of the Haib mineral. Recoveries of 80% and 82% were showed to be very achievable and sustainable for the project by the test-work to date.

Further work is required in order to refine and optimize process conditions to improve recoveries and operating costs.

Run-of-Mine mineral Bio heap leaching was determined to be the most viable process route for the Haib mineral. Six processing scenarios were established with the key variables being recoveries, final products (copper cathode and copper sulfate) and metal price. The base case chosen by Koryx Copper is the scenario (1) below, which is based on the production of copper cathodes and copper sulfate. All financial metrics are based on the recent 43-101 indicated resource estimation of 456.9 MT @ 0.31% Cu:

Table 1: Scenario 1 – project metrics

| 20 Mtpa @ 80% Cu Recovery + CuSO4 | |||||

|---|---|---|---|---|---|

| LME Cu, tpa | 35,332.3 | ||||

| CuSO4.5H2O, tpa | 51,080.9 | ||||

| CAPEX, (US$M) | $341 | ||||

| OPEX, (US$M / year) | $91 | ||||

| Avg Annual RevenueLME Cu (US$M) | $195 | ||||

| Avg Annual RevenueCuSO4 (US$M) | $90 | ||||

| Total Cost, US$/t ROM | $7.64 | ||||

| Total Cost, US$/lb CuEq | $1.34 | ||||

| Copper Price, US$/lb | $2.00 | $2.25 | $2.50 | $2.85 | $3.00 |

| NPV7.5%, pre-tax (US$ M) | $424 | $701 | $977 | $1,364 | $1,530 |

| IRRpre-tax | 18.6% | 24.6% | 30.1% | 37.3% | 40.2% |

| Payback Period pre-tax | 6.91 | 5.21 | 4.22 | 3.38 | 3.13 |

| NPV7.5%, after-tax (US$ M) | $119 | $439 | $611 | $853 | $957 |

| IRR after-tax | 14.9% | 18.9% | 22.7% | 27.6% | 29.7% |

| Payback Period after-tax | 8.87 | 6.94 | 5.71 | 4.59 | 4.23 |

| Strip Ratio | 1.41:1 | ||||

| LOM, years | 24 | ||||

Note: The PEA is based only on the estimated indicated resource and the inferred resource are not part of this economic assessment

With further metallurgical work and testing, the company’s goal is to attain higher recovery rates. The below scenario (2) illustrate the potential economic upside of higher recoveries:

Table 2: Scenario 2 – project metrics

| 20 Mtpa @ 85% Cu Recovery + CuSO4 | |||||

|---|---|---|---|---|---|

| LME Cu, tpa | 38,336.8 | ||||

| CuSO4.5H2O, tpa | 51,080.9 | ||||

| CAPEX, (US$M) | $341 | ||||

| OPEX, US$/year | $96 | ||||

| Avg Annual RevenueLME Cu (US$M) | $211 | ||||

| Avg Annual RevenueCuSO4 (US$M) | $90 | ||||

| Total Cost US$/t ROM | $7.91 | ||||

| Total Cost, US$/lb CuEq | $1.32 | ||||

| Copper Price, US$/lb | $2.00 | $2.25 | $2.50 | $2.85 | $3.00 |

| NPV7.5%, pre-tax (US$ M) | $503 | $796 | $1,088 | $1,498 | $1,673 |

| IRR pre-tax | 20.4% | 26.5% | 32.2% | 39.6% | 42.6% |

| Payback Periodpre-tax | 6.32 | 4.83 | 3.94 | 3.18 | 2.94 |

| NPV7.5% after-tax (US$ M) | $119 | $497 | $681 | $937 | $1,04 |

| IRR after-tax | 16.0% | 20.2% | 24.1% | 29.2% | 31.3% |

| Payback Period after-tax | 8.22 | 6.47 | 5.34 | 4.30 | 3.98 |

| Strip Ratio | 1.41:1 | ||||

| LOM, years | 24 | ||||

Note: The PEA is based only on the estimated indicated resource and the inferred resource are not part of this economic assessment

Please note that: Mineral Resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates ar based on Indicated Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. However, there is no certainty that these indicated mineral resources will be converted to measured categories through further drilling, or into mineral reserves, once economic considerations are applied. There is no certainty that the preliminary economic assessment will be realized.

Other scenarios

The other scenarios can be found in the NI 43-101 technical report for the Haib Copper project filed on SEDAR under Koryx Copper’s profile and on the web site of the company.

Mineralogy

The Haib Copper Deposit is a large sulfide mineral deposit. Copper is mainly present as a sulfide in the form of chalcopyrite. Copper is also present as oxides (chrysocolla, plancheite, malachite and azurite), occurring as intrusions in shear zones.

Initial testwork results showed that the Haib mineralisation is a competent quartz feldspar porphyry rock.

It can be seen that the main mineral is copper with only an accessory amount of molybdenum present. The chalcopyrite also occurs as occasional coarse irregular grains from 0.1 mm to 0.35 mm.

Mining Methods

Considering the Haib copper deposit characteristics, the suitable mine design is based on an open pit method. As the deposit is basically composed of hard rock material, the mining operations will involve drill and blast of all excavated material, which will be segregated by cut-off grade.

The mining fleet considered for the Haib project would consist of appropriately sized hydraulic excavators and off highway dump trucks, depending, supported by standard open-cut drilling and auxiliary equipment.

Initial open pit mine design work undertaken indicates a strip ratio of 1.41:1 for 20 Mtpa. The low strip ratio has a significant effect on the low operating cost indication of the project.

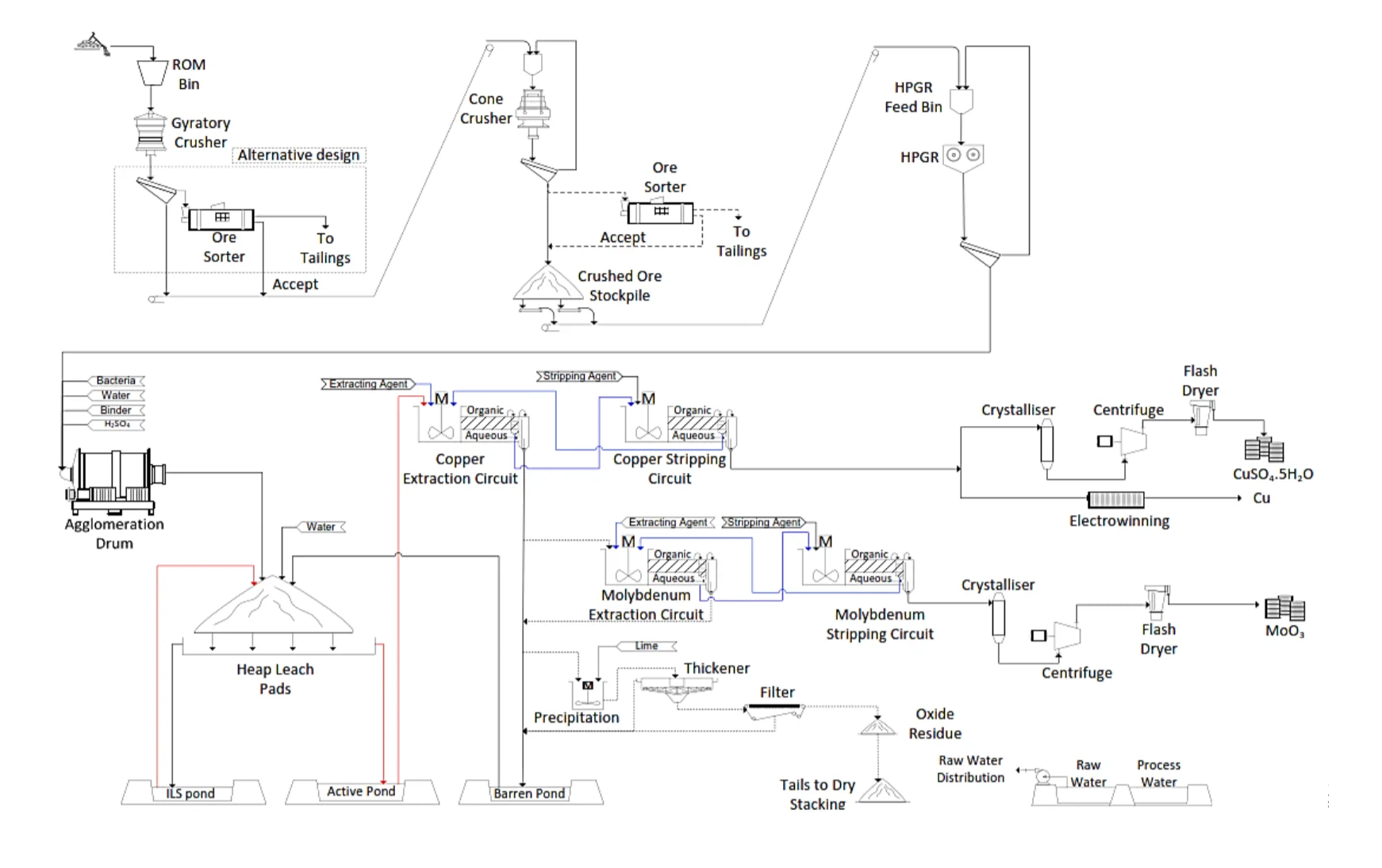

Recovery Method

For the recovery of copper from the Haib deposit, heap leaching was considered for all options. The primary reasons for the selection of heap leaching are the low-grade nature of the deposit and the vast scale of the mineral body. Previous work conducted on the Haib Project suggested that a conventional crush-grind-float and sale of copper concentrate is not economically feasible under the current copper market conditions. The low costs associated with heap leaching compared to a whole mineral flotation circuit is believed to improve the viability of the project. Heap leaching is traditionally performed on oxide material, although there has been increasing development in the application to acid-insoluble sulfides.

Previous sighter amenability test-work, carried out by Mintek, METS and SGS South Africa, suggests that high amounts of copper can be extracted from the Haib material, up to 95.2% via a bacterial assisted leaching. However, additional test-work is required to determine the optimal operating parameters. The system design proposed will use 3 stage crushing and a mineral sorting system (either on the primary crushed product or the secondary crushed product depending on the technology selected) that will provide higher grade mineral to the heaps. The primary crusher will reduce the rock to 127 mm (gyratory crusher), the secondary crusher to 32 mm (cone crusher) and the tertiary crusher to 5 mm (HPGR).

Haib Copper flow sheet diagram

(on the following page)

Capital Cost

Table 6:

Capital cost breakdown @ 80% Cu recovery at a price of US $ 2.50 per lb of copper

| Direct Cost (US$M) | 20 Mtpa |

|---|---|

| Crushing & HPGR | 100.1 |

| Agglomeration & Heap Leaching | 43.2 |

| Copper Solvent Extraction | 72.9 |

| Iron Removal | 6.3 |

| Process and Raw Water | 4.1 |

| Reagents | 5.0 |

| Services | 2.9 |

| Supporting Infrastructure | 3.0 |

| First Fill | 8.3 |

| Indirect Cost (US$M) | |

| Working Capital | 24.7 |

| Insurance | 7.4 |

| EPCM | 24.7 |

| Contingency | 24.7 |

| Commissioning | 5.0 |

| Accommodation & Temp Services | 5.0 |

| Spares & Tools | 3.0 |

| Total (US$M) | 340.3 |

Operating Costs

Total operating costs, including capital leases as an operating expense, are estimated in the PEA and are broken down as follows:

Table 7:

Total operating cost breakdown – Scenario 1

| 20 Mtpa @ 80% Cu Recovery + CuSO4 @ US 2.50 per lb / Cu | ||||

|---|---|---|---|---|

| Area | Annual Cost | Unit Cost | Unit Cost | |

| (‘000 USD) | (USD/t ROM) | (USD/lb CuEq) | ||

| Mining | 45,200 | 2.26 | 0.40 | |

| Processing | 90,799 | 4.54 | 0.80 | |

| Product Freight | 3,889 | 0.19 | 0.03 | |

| Wharfage & Shiploading | 432 | 0.022 | 0.004 | |

| Administration | 4,000 | $0.20 | 0.04 | |

| Royalty | $2.00 | 6,824 | 0.34 | 0.06 |

| $2.25 | 7,677 | 0.38 | 0.07 | |

| $2.50 | 8,530 | 0.43 | 0.08 | |

| $2.85 | 9,724 | 0.49 | 0.09 | |

| $3.00 | 10,236 | 0.51 | 0.09 | |

| Total | $2.00 | 151,144 | 7.56 | 1.33 |

| $2.25 | 151,997 | 7.60 | 1.34 | |

| $2.50 | 152,850 | 7.64 | 1.34 | |

| $2.85 | 154,044 | 7.70 | 1.35 | |

| $3.00 | 154,556 | 7.73 | 1.36 | |

Note: Mineral Resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates are based on Indicated Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. However, there is no certainty that these indicated mineral resources will be converted to measured categories through further drilling, or into mineral reserves, once economic considerations are applied. There is no certainty that the preliminary economic assessment will be realized.

Tailing Disposal

There will be no tailings. The spent heaps will be rehabilitated and left in place. Due to environmental reasons and water resources, the tailings from the pH adjustment process and the iron removal process will be disposed onto the spent heaps via the method of filtered dry stacked tailings.

Environmental considerations

In terms of environmental aspects, dry stack facilities offer a number of advantages to other surface tailings storage options – some of these include:

Waste rock storage

It is suggested to consider stockpiling the low-grade mineral to process it at the end of mine life, in case the copper price increase considerably by the end of the mine life and/or a new mineral processing technology be created or developed.

Products

LME Copper (cathodes)

Copper is one of the most widely used metals on the planet. China, Europe and the USA are the main global consumers of copper. Copper will be produced on the cathode of the electrowinning cell as pure sheets, which will be a pure (99%) solid. Pure copper metal is used for a variety of purposes. The major use is electrical wiring due to the great electrical conductivity of copper. Additionally, copper is used in many metal alloys such as brass and bronze, which are stronger and more corrosion resistant than pure copper.

Copper Sulfate

Copper sulfate will be sold as a blue powder when the crystals are crushed and dried. Copper sulfate is used in multiple industries such as arts, mining, chemical, pharmaceutical, healthcare and agriculture. The biggest use is for farming as an herbicide or fungicide. Additionally, it inhibits the growth of E-Coli. In the healthcare sector, it is used in sterilizers and disinfectants and can be used to control proliferation of bacteria and viruses. Industrial usage could be in adhesives, building, chemical, textile industries, etc. where it is used to manufacture products like insecticides, wood preservatives and paints. High purity copper sulfate has a 25% premium price based on the copper content in the sulfate.

Sulphur Burning Plant

The design for each option as it stands involves the burning of sulphur to produce sulphuric acid. There are several possibilities for sulphuric acid sourcing, including purchasing from smelters within Namibia.

Buying in sulphuric acid at the start of the project life and building a sulphur burning plant once the project is cash flow positive may provide a better economic scenario.

This will allow for the sulphur burning plant capital to be deferred and the payback period to be shortened.

Recommendations

The results from the PEA have been promising and provides a fundamental support for Koryx Copper intention to move the project towards the Feasibility Study phase on the of the deposit.

Koryx Copper has set a target of achieving 85% copper recovery as a basis of design in the feasibility study. Some of the parameters to be evaluated in the study are:

Infill drilling in the high-grade area of the deposit, which can be included in the early part of the mine schedule is recommended. This will improve project economics in the financial model.

A drill program of 12,000 meters is recommended to infill a high grade section of the deposit. With a closer grid spacing, a high-grade part of the deposit could be included in the first years of mining to improve the economics and pay-back period.

Further to the Feasibility Study and the drilling of the mineral body as above, a small Pilot Plant is recommended on-site to validate and optimize the process under local conditions. The detailed engineering information and optimization would provide improved confidence in proceeding with a commercial operation.

The work conducted to date provides confidence to move forward, and there is every possibility of improving copper recovery and reducing the operating costs further.

Project Risks

Further information about the PEA and the resource estimate referenced in this news release, including information in respect of data verification, key assumptions, parameters, risks and other factors, can be found in the NI 43-101 technical report for the Haib Copper project that will be filed on SEDAR under Koryx Copper’s profile.

Opportunities

Other opportunities are presented in the the NI 43-101 technical report for the Haib Copper project that will be filed on SEDAR under Koryx Copper’s profile.

Project Expansion:

The resource tonnage allows for possible multiple expansion stages to be executed should the project proceed to once in production. A staged approach is recommended in order to de-risk the project by projecting that the project achieves positive cash flow prior to plant expansions.

Way Forward

The results from the updated PEA have been promising, Koryx Copper intends to undertake a Feasibility Study for the deposit. The program will include but not limited to: infill drilling of the high-grade area in order to define the grade and estimate a measured resource, detailed mine design, measured resource definition, metallurgical and process technologies test work, engineering design and an environmental impact study.

Qualified Person

Damian E.G. Connelly, BSc (Applied Science), FAusIMM, CP (Met), Principal Consulting Engineer of METS Engineering Group is the main author of the Preliinary Economic Assessment report and is responsible for the technical part of this press release and is the designated Qualified Person under the terms of National Instrument 43-101.

As the operator of the project from 2010 to 2016, Teck took a more regional view of the project than previous operators. Their exploration objective was to provide the required data to show that the deposit had potential for large-scale mining, particularly if the tonnage or grade, or both, could be improved and that early stage mining could exploit sufficient high-grade mineralization to improve the economics of mining. They started a new exploration program both to investigate the open ended parts of the deposit (deep drilling and extension drilling) and to explore for new, undiscovered outlying mineralization. This had not been previously attempted.

Following this model, from 2008 to date, Teck have completed the following work:

| 2010 | 2011 | 2012 | 2014 |

|---|---|---|---|

| 121m @ 0.5% Cu & 0.027% mo |

39m @ 0.53% Cu & 0.02% Mo |

32m @ 0.79% Cu & 0.01% Mo |

25m @ 0.66% Cu & 0.019% Mo |

| 494m @ 0.36% Cu & 0.018% Mo |

45m @ 0.53% Cu & 0.002% Mo |

30m @ 0.81% Cu & 0.007% Mo |

53m @ 0.41% Cu & 0.012% Mo |

The results from the recent Preliminary Economic Assessment (PEA) are highly promising and METS recommends to Koryx Copper to complete a Feasibility Study (FS) for the deposit.

Koryx Copper plans to undertake the Feasibility Study (FS) by the end of Q4 2020.

The program includes: